| |

||

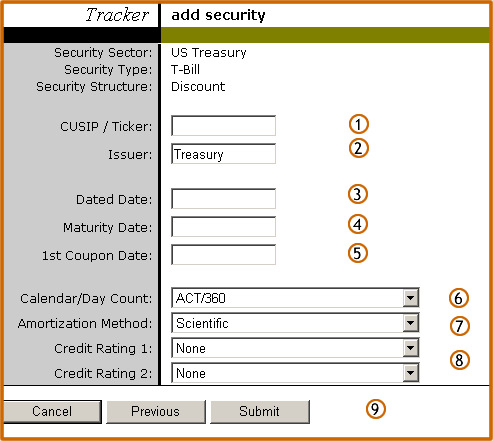

Security Center: Add

Information essential for identifying the security and for making calculations for accrued interest, yields, discount and premium amortizations, duration, etc. must be entered in Tracker. This page will vary depending on the Security Sector, Security Type and Security Structure selected on the previous page. This example illustrates the information required for a discount security. |

|

| Enter the CUSIP that is to be used to identify the security. For a stock or mutual fund, the identifying stock symbol would be entered. | |

| Enter the name of the issuer. For a treasury security, the issuer would be Treasury and for an Agency security this would be the same as the security type (example: FNMA, FHLMC, etc). For other securities, this would be the name of the institution or corporation that issued the security. | |

| Enter the Dated Date. This is the date that interest begins to accrue. | |

| Enter the Maturity Date | |

| Enter the 1st Coupon Date. For discount and zero coupon securities, the first coupon date is the same as the maturity date. | |

| Select the Calendar/Day Count used in computing interest for this type of security. Tracker pre-selects the calendar/day count typically used for the type of security selected, but users have the option to select a different one when appropriate. | |

| Select the Amortization Method to be used in computing discount and premium amortizations for this security. The scientific method and straight-line method are the two options in Tracker. | |

| Select the appropriate credit rating or ratings for this security. If this is not known or is not applicable to the security, select none | |

| After reviewing the completed fields, click the Submit button if all information entered or selected appears to be accurate. The Cancel or Previous buttons will erase all information entered or selected in Steps 1-8 |